The rising cost of project development has pushed primary apartment prices in Ho Chi Minh City to over 80.2 million VND/m². As a result, apartments under 3 billion VND are gradually shifting to nearby provinces, where land availability is abundant, and development costs are lower.

New Price Levels in Ho Chi Minh City’s Eastern Area

According to the Market Research and Customer Insights Center at OneHousing, the lack of supply and scarcity of mid-range projects have driven the city’s average apartment price in Q3 2024 to 80.2 million VND/m², marking a 5% increase from the previous quarter.

Luxury and high-end apartments dominate the market, with 90% of new supply priced above 60 million VND/m² (excluding VAT and maintenance fees). Notably, the Eastern area of Ho Chi Minh City, which accounted for 65% of new supply in the first nine months of 2024, has established a new price benchmark. Previously halted projects in this area have resumed, with prices now 2–3 times higher than initial offerings. Most upcoming projects in the East are projected to exceed 100 million VND/m².

Consequently, apartments priced under 3 billion VND are vanishing, following the earlier disappearance of units under 2 billion VND in 2023 and under 1 billion VND in 2020.

Source: OneHousing

The Driving Factors Behind Rising Prices

Trần Minh Tiến, Director of Market Research at OneHousing, explained that in major cities like Ho Chi Minh City, legally cleared land for commercial housing projects is increasingly scarce, driving land prices higher.

“The city’s updated land price framework, effective until 31/12/2025, and annual updates starting in 2026 have significantly increased compensation costs for land clearance. Coupled with macroeconomic fluctuations, these factors have raised development costs, causing apartments under 3 billion VND to disappear and shift to neighboring provinces with more available land and lower costs,” Mr. Tiến said.

Recovery Signals: A Good Time for Investment

Despite high prices, Ho Chi Minh City’s real estate market is showing a strong recovery in both supply and demand, with the Eastern area, particularly District 2 (now part of Thu Duc City), as the focal point. Successful launches of projects like Masteri Grand View (over 2,500 early bookings) and Eaton Park (over 1,300 early bookings) have provided a substantial boost to the market.

Several other projects are scheduled to launch in December, while previously halted projects have resumed following the enactment of revised laws in August 2024. These developments have bolstered buyer and investor confidence.

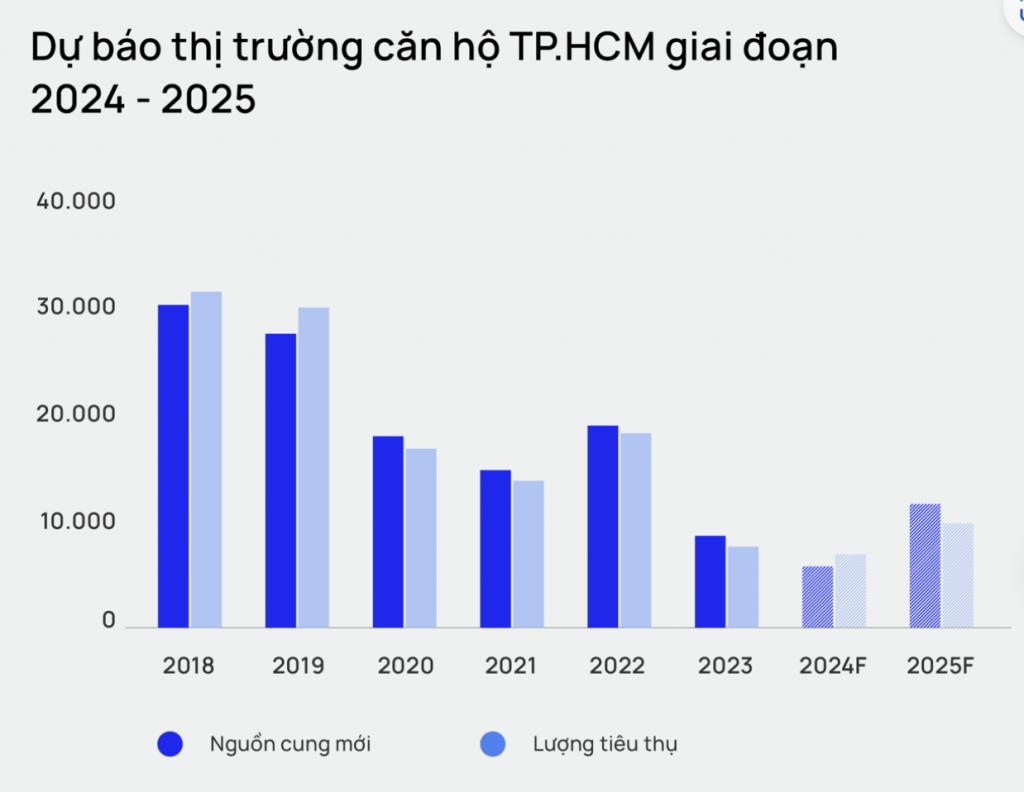

According to Mr. Tiến, the new supply in 2025 is expected to double that of 2024, reaching approximately 12,000 units, signaling a significant market recovery.

The expert highlighted three key growth drivers for the high-rise market in Ho Chi Minh City during 2024–2025:

- Integrated and synchronized infrastructure development.

- Revised laws resolving legal bottlenecks for projects.

- Growing housing demand from Vietnam’s expanding middle class.

“Currently, Ho Chi Minh City offers an ideal time for investment. Developers are increasingly flexible with payment policies and financial support, enabling buyers to access quality projects more easily. Prime-location projects continue to record robust price growth. However, both investors and homebuyers must carefully evaluate products that align with their needs and financial capabilities,” Mr. Tiến advised.