Guide to Buying an Apartment Without a House Ownership Certificate

Buying an apartment without a House Ownership Certificate offers financial benefits but also comes with legal risks and potential disputes. To minimize these risks, refer to the following guide on the process and necessary procedures.

Should You Buy an Apartment Without a House Ownership Certificate?

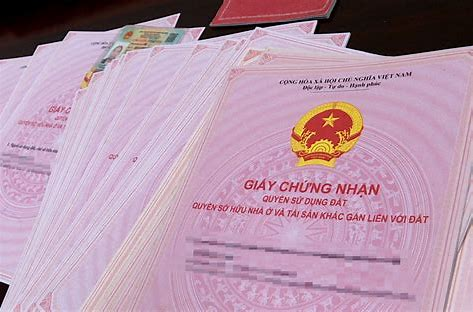

What Is a House Ownership Certificate?

A House Ownership Certificate is an official document issued by the Ministry of Construction that verifies ownership of an apartment and the right to use the land it is built on. If you own an apartment but not the land, you will be granted this certificate, confirming your legal ownership.

Legally referred to as the Certificate of Land Use Rights, Ownership of Residential Houses, and Other Assets Attached to Land, this document ensures that buyers who meet all financial and contractual obligations with developers can obtain ownership certification in compliance with the law.

Unlike traditional land titles, the House Ownership Certificate applies exclusively to apartment units, restricting ownership rights to the built property rather than the underlying land.

Legal Value of the House Ownership Certificate

This certificate serves as legal proof of apartment ownership, issued by competent authorities to legitimate owners. However, not all apartment projects qualify for a House Ownership Certificate. Many apartments are sold without this certification at a lower price than comparable certified units, attracting buyers seeking cost savings.

Despite the price advantage, purchasing an uncertified apartment poses risks. According to current regulations, apartments without a House Ownership Certificate can only be transferred through a management and usage authorization contract, which essentially acts as a purchase agreement but does not guarantee legal ownership. Buyers may face potential issues such as losing contact with the seller, dealing with an incapacitated or deceased original owner, or encountering developer-related complications.

Additionally, after placing a deposit, reselling an uncertified apartment remains challenging since the developer will only register the original buyer as the official owner. Subsequent purchasers will only receive usage authorization, limiting their rights.

For ongoing projects awaiting certification, transactions must proceed via full-power authorization, as developers cannot verify ownership while their applications are under review by the Department of Natural Resources and Environment.

If buyers fail to research thoroughly, they risk purchasing from unreliable developers, resulting in delays or the inability to obtain a House Ownership Certificate.

Key Considerations Before Buying

To mitigate risks, buyers must verify the apartment’s legal status and ensure that the property meets all certification conditions before committing.

Procedures for Buying an Apartment Without a House Ownership Certificate

Conditions for Transfer

According to Article 123 of the 2014 Housing Law, further detailed in Article 32 of Circular 19/2016/TT-BXD, conditions for transferring an apartment purchase agreement include:

- The original buyer (individual or organization) has either not yet received the apartment or has taken possession.

- The property has not been submitted for House Ownership Certificate registration.

Transaction Process

Step 1: Drafting the Transfer Agreement

According to Article 33 of Circular 19/2016/TT-BXD, both parties must draft a contract containing the following details:

- Buyer and seller information

- Original apartment purchase contract details

- Transfer price, payment terms, and deadlines

- Rights and obligations of both parties

- Dispute resolution terms

- Additional agreements

The contract must be created in seven copies (three for the developer, one for tax authorities, one for each party, and one for notarization).

Step 2: Notarization or Certification

For individuals or families, the agreement must be notarized or certified. Required documents include:

- Seven original copies of the transfer agreement

- The original apartment purchase contract

- A certified copy of the buyer’s identification documents (passport, ID card, or citizen identification card)

- Additional documents per notarization requirements (e.g., marital status verification)

Step 3: Tax and Fee Declaration

Step 4: Developer Confirmation

After tax payments, the new buyer must submit a confirmation request to the developer. Required documents:

- Five original copies of the transfer agreement

- The original apartment purchase contract

- Tax payment receipt or exemption proof

- Certified copies of identification documents

The developer must confirm the transfer within five working days of receiving the complete application.

Important Notes When Buying an Apartment Without a House Ownership Certificate

If you are considering purchasing such an apartment, ensure you follow these steps based on the seller type:

Buying Directly From the Developer

- Sign a purchase contract directly with the developer.

- If the certificate is not issued upon handover, notarize the purchase contract for legal protection.

- Specify the certificate issuance timeline in the contract.

- Consider withholding a portion of the payment until receiving the certificate.

Buying From a Secondary Developer

- Transactions must be conducted through a real estate trading platform, as per Circular 16/2010 of the Ministry of Construction.

- Have the contract notarized to ensure legal security.

Buying From Individuals or Households

- The seller must present the original purchase contract with the developer during notarization.

- If the apartment has been resold multiple times, the latest purchase contract must be verified.

- The transaction should be processed at a notary’s office to ensure legal protection.

Conclusion

Buying an apartment without a House Ownership Certificate may provide cost benefits but also carries legal risks, including potential ownership disputes and resale restrictions. Ensuring legal compliance, verifying developer credibility, and following proper transfer procedures can help buyers minimize risks and protect their investments.